Brazil Could Lead the Emerging Markets Sector Higher

“When defeat comes, accept it as a signal that your plans are not sound, rebuild those plans, and set sail once more toward your coveted goal.”Napoleon Hill, Think and Grow Rich

After approaching stock market highs, the market failed to break out to the upside. A short term decline began with the S&P 500 falling for five straight days. International markets were also under pressure with poor economic news out of China and tension in Ukraine. Investors this year have purchased sectors that were out of favor last year such as gold, municipal bonds and preferred stocks, which have all been profi table this year. I believe the recent selling pressure was an aberration caused by the unwinding of options for the triple witching of March 22 expirations, the uncertainty in Ukraine, and the new development of a possible increase in interest rates starting in mid-2015.

In the last newsletter I was looking for further upside despite negative divergences, because the Russell 2000 (IWM) had regained leadership in relative strength over the S&P 500. I was also expecting a buy signal from our weekly breadth model, but the signal didn’t materialize and we didn’t rally. The Russell 2000 (IWM) is a more volatile market average and has more risk than the S&P 500. The Russell 2000 (IWM) fell similar to other market indexes despite being more volatile. As of this writing, the Russell 2000 (IWM) is holding above key support at 115.00.

What are the Weekly Brazil (EWZ) and Emerging Markets (EEM) Charts Saying Now?

My favorite area for upside potential is emerging markets, including securities such as the iShares MSCI Brazil Index ETF (EWZ). I wrote about the oversold condition on the monthly chart in the January 24, newsletter. The ETF measures the broad-based equity performance in Brazil (EWZ), one of the weaker emerging markets areas that are now showing strength.

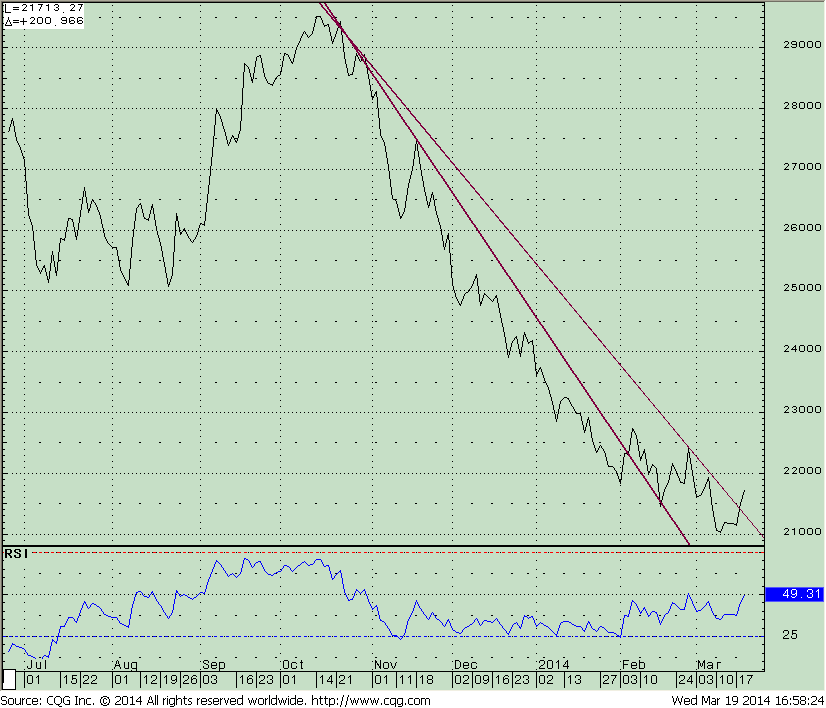

See the top portion of the weekly chart on which I have drawn two trend lines. EWZ has been in a downward trend since April 2011. The short term downtrend from October 2013 was broken to the upside on March 18, 2014 giving an upside objective to 46, almost 15% higher. This level also coincides with the downtrend trend line from April 2011, where the next level of resistance lies. In the bottom portion of the chart, the Relative Strength Index (RSI 14) has traced out a rising double bottom pattern from an oversold position which is bullish.

The bottom half of the chart on page 4 is the weekly iShares MSCI Emerging Markets Index ETF (EEM). This ETF focuses on emerging market large and mid-cap stocks. As of March 18, 2014 the top holdings are China 18.02%, South Korea 15.88%, Taiwan 12.24% and Brazil 10.56%. Notice the Relative Strength Index (RSI 14) on the lower chart has turned up with a bullish rising double bottom. With weakness in China and Korea both having high weightings above 15%, the EEM has lagged and the short term down trend from October 2013 remains intact.

When the economic news quiets down and begins to improve, investors might see this as a buying opportunity, and money could begin to move into this area, with prices moving higher. A rise above 40.00 would break the downtrend. The short term objective is 42.50 followed by 45.

EWZ/SPY Daily Relative Strength

More evidence that Brazil could be the next leader is shown in the chart to the right. Brazil lagged the S&P 500 since October of 2013. In February 2014 the downtrend was broken but the rally in Brazil failed. This sometimes happens when an area has been weak for a long period of time. A shift has now taken place, the Daily EWZ/SPY relative strength ratio has turned up, and the downtrend line has been broken. Momentum is improving with the Relative Strength Index (RSI14) in favorable position with a rising double bottom.

The recent decline from the highs was short lived. Prices stabilized but then another scare occurred after the news from the Fed that rates will rise sooner than expected. Negative divergences exist on some of the US equities charts but so far major support levels are holding. Trend-following technical indicators will remain bullish until early May. Options expiration will soon be behind us, market volatility could continue in both directions until the market breaks out to new highs or support levels are broken to the downside. If the emerging markets can rally from here, this would be bullish for the US market as well. I continue to give the benefit of the doubt to the bulls.

What are your thoughts about the Emerging Markets? Are you expecting higher or lower prices?

Please Email me: bgortler@signalert.com; phone: 1-800-829-6229 with any comments or insights.

GET A FULL YEAR OF THE SYSTEMS & FORECASTS NEWSLETTER

for a SPECIAL DISCOUNT – $99

This is a hypothetical result and is not meant to represent the actual performance of any particular investment. Future results cannot be guaranteed.

Although the information is made with a sincere effort for accuracy, it is not guaranteed either in any form that the above information is a statement of fact, of opinion, or the result of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments discussed above for their own particular situations and for determination of their own risk levels.