Watch S&P 500 (SPY) and Small Caps (IWM) To Fuel The Fourth Quarter Rally

The fourth quarter rally remains intact, with October a very strong month for the U.S. and international markets.

The strongest sectors (as of intraday on 10/27/15) are:

The Nasdaq 100(QQQ) +10.89%,

Korea (EWY) +11.30%, and

China (FXI) +10.12%.

The S&P 500 SPDR (SPY) is also is having a solid month, up 7.53%. The S&P500 (SPY) has penetrated short term resistance of 204.00, but has struggled to get through more resistance at 207.50 mentioned in the 10/02/15 newsletter.

The market rally has been broad, however small caps continue to underperform. The Russell 2000 Index (IWM) has gained only +3.86%, unable to penetrate resistance at 120.00, or generate any bullish thrust signals so far. If the IWM could get above 120.00 an upside objective to 130.00 would be given.

With the large advance this month, the market remains overbought and ripe for a pullback. It’s possible that the market could go straight up from here without a pullback, if the small caps get stronger sooner rather than later. November is one of the best performing months of the year. Also kicking in is favorable small-cap seasonality that historically begins late November which will support the market.

Where Do The Troublesome Patterns from the 10/25/15 Newsletter Stand Now?

- The Financials (XLF) have stabilized, showing signs of life: up 5.32% this month even with interest rates not expected to rise until 2016. Watch financials (XLF) to see if they get stronger than the S&P 500 by following the (XLF/SPY) relative strength ratio for a turn-up, signifying that financials will lead.

- Healthcare (XLV) is acting much better after the recent sell-off. This month XLV is up 6.86% through 10/27/15 intraday, helped by stocks with favorable earnings reports. Healthcare (XLV) is now stronger than the S&P 500 (SPY) with the XLV/SPY relative strength ratio turning up on both the daily and weekly charts. Also, MACD has given evidence that downside momentum has subsided, as it has broken the downside trendline from July’s peak, a positive development for the short term in this sector.

- Biotechnology (XBI) is no longer declining after selling off sharply, showing gains of 8.16% for the month.The XBI/SPY relative strength ratio has turned up on the daily and weekly charts. Biotechnology (XBI) is now stronger than the S&P 500 (SPY) for the short and intermediate terms, a good sign. However price remains below 70.28, the area at which XBI broke down, still trading below key support. If you are invested in biotechnology don’t overstay your welcome, because it’s a volatile index that has high risk and needs to be monitored.

Even with the gains from October, the long term trend remains unfavorable since so many indices broke their up-trends from 2009. With the recent rally, a potential bearish double top pattern could be forming if new highs are not made and the rally fails.

Our models have improved, but further confirmation is still needed to show that risk is constrained to produce a lower risk environment.

What Do The Charts Say?

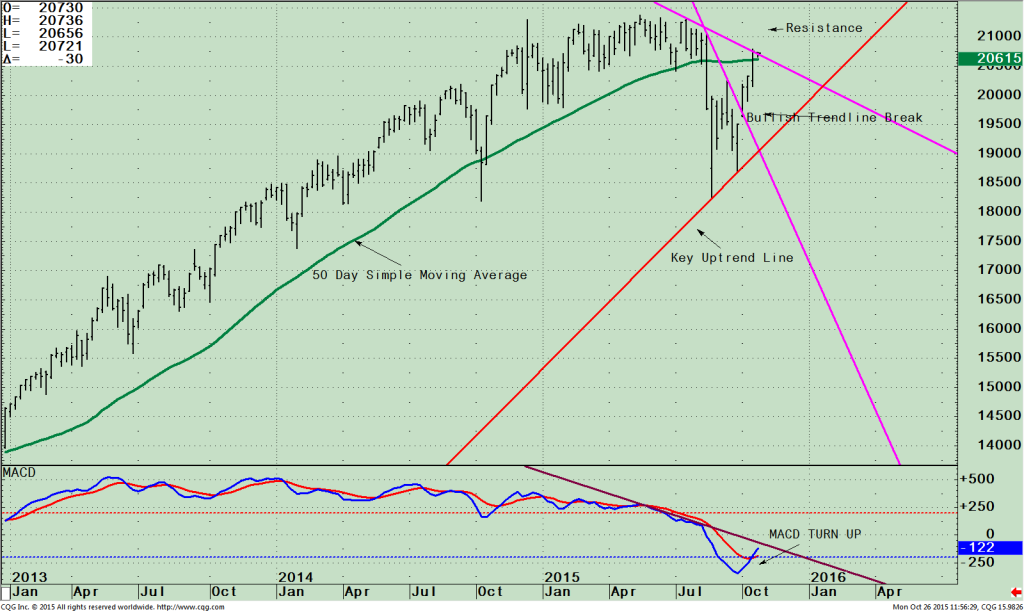

SPDR S&P 500 (SPY) Weekly ETF (Top) and MACD (Bottom)

The top portion of the chart shows the weekly S&P 500 (SPY). I have drawn the key lines and areas that I am watching now for further direction of the market:

1. 50-day Simple Moving Average (green)

2. Key Uptrend Line (red)

3. Resistance

4. Bullish Trend Break (pink)

5. MACD Turn-up

The S&P 500 has rallied towards the 50 Day Simple Moving Average (green line), 206.15 (at the time of this writing) after successfully testing the August lows. If the S&P 500 (SPY) could get through resistance at 207.50 first, then 210.00 this would be a sign of strength and a move to 220 would be a real possibility.

If the market stalls now, a potential decline to 190.00 could occur in which the signifi cant up trendline (red line) and the bullish trend line break (pink line) are acting as key support.

A break below 184.00 would break the uptrend and the odds would increase that a serious decline would follow and potentially the 08/25/15 lows would be violated.

The lower portion of the chart is the technical indicator MACD, (a momentum indicator). MACD is below 0, oversold, and has turned up since the last newsletter advocating that this is a safe buy. The expectation is that the S&P 500 will continue to rise, and not go back down to test the lows again.

I still believe the bottom is in, and the fourth quarter rally has begun and is here to stay. I am expecting the S&P 500 to get through resistance at 210.00 and a broader market rally to develop.

Just to Sum Up:

- The overall market has changed its character, with the expectation of no Fed rate hike likely and more support from the European Central Bank. This helped the global markets stabilize, to show strong gains in October.

- With the market advance in October, investors were enticed to move capital into sectors that have more risk, with technology, biotechnology and international stocks improving and acting better.

- Money appears to be moving away from defensive areas such as Utilities (XLU) and Consumer staples (XLP) since the test of the lows on 09/29/15.

- Small Caps have lagged the S&P 500 (SPY) instead of being stronger, with investors not willing to take on the risk of investing in large caps. I am expecting this to change, as favorable seasonality for the small caps is around the corner.

- Late November historically is when favorable seasonality begins, but could start sooner than expected. Watch to see if the IWM could get above 120.00 giving an upside objective to 130.00. This could provide evidence that the rally will broaden even further, with more stocks participating in the fourth quarter rally that has begun.

I would love to hear from you! Please feel free to share your thoughts, ask your questions or share your comments with me. Please call 1-844-829-6229 or email me at bgortler@signalert.com.

*******Article in Systems and Forecasts October 29, 2015

Grab Your Free Trial of the Systems and Forecasts newsletter where I am the Guest Editor

Click Here http://bit.ly/1fM79hp

This is a hypothetical result and is not meant to represent the actual performance of any particular investment. Future results cannot be guaranteed. Although the information is made with a sincere effort for accuracy, it is not guaranteed either in any form that the above information is a statement of fact, of opinion, or the result of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments discussed above for their own particular situations and for determination of their own risk levels.