The market reversed lower last week, with only two of eleven S&P SPDR sectors finishing higher. Energy (XLE) and Utilities (XLU) were the leading sectors, while Materials (XLB) and the Industrial Sector (XLI) were the weakest. The SPDR S&P 500 ETF Trust (SPY) was down -1.26%.

S&P SPDR Sector ETFs Performance Summary 9/1/23-9/8/23

Source: Stockcharts.com

Figure 2: Bonnie’s ETFs Watch List Performance Summary 9/1/23-9/8/23

Source: Stockcharts.com

Small Cap Value and Growth, China, Semiconductors, and Transports were much weaker than the S&P 500, while Hi Yield Bonds fell the least.

Support remains intact

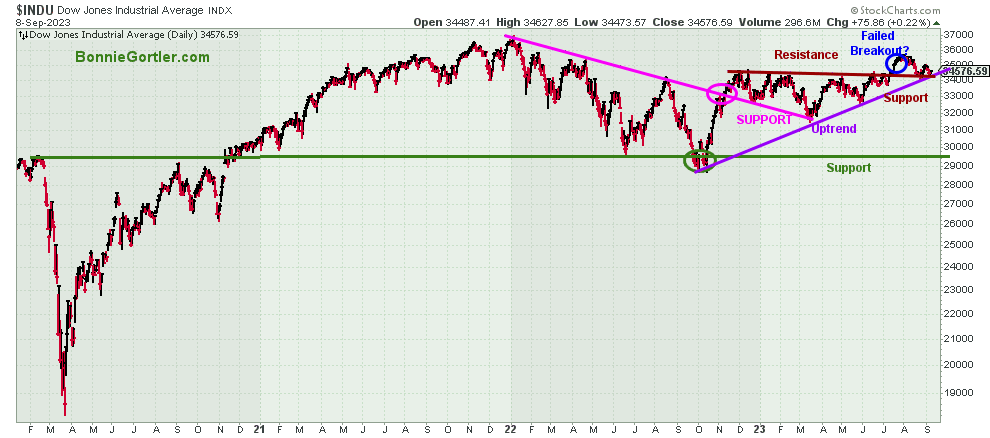

Figure 3: Dow Jones Industrial Average

Source: Stockcharts.com

The Dow Jones Industrial Average fell -0.75%, closing at 34576.59, still holding key support for now, and the October 2022 price uptrend remains in effect.

A weekly close below 34300 would imply a decline towards 34000 in the near term. However, two closes above 35567 could fuel Dow stocks that underperformed in 2023 and confirm the pullback is only a normal retracement after the breakout in July (blue circle) above resistance.

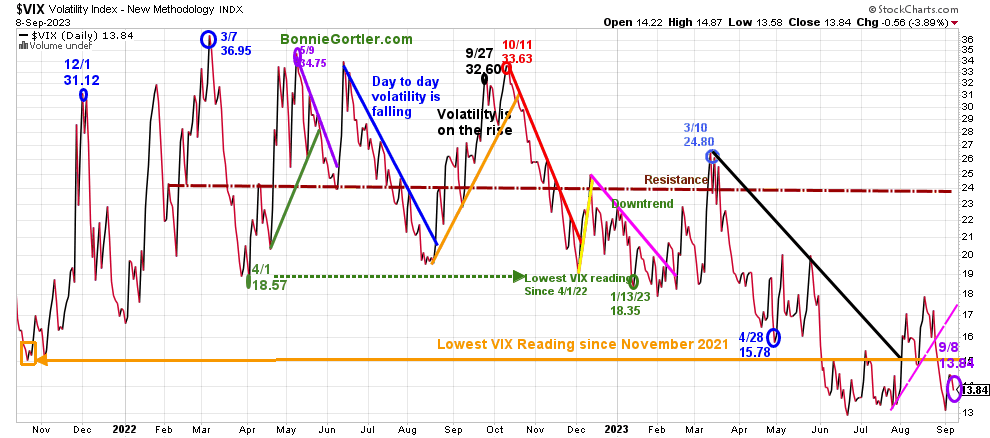

Figure 4: CBOE Volatility Index VIX

Source: Stockcharts.com

The CBOE Volatility Index (VIX), a measure of fear, traded above 20.00 for most of 2022, with a high at 36.95 on 3/7 (blue circle). A new VIX low did not occur until 1/13/23 at 18.35 (green circle) after peaking in October 2022 at 33.63 (red circle).

VIX rose from 13.09, a low reading, historically the previous week, to 13.94 (purple circle) last week, remaining near the lows for the year and not suggesting high volatility ahead. Expect quiet intraday volatility with VIX below 20. A close above 20.00 would imply volatility increasing.

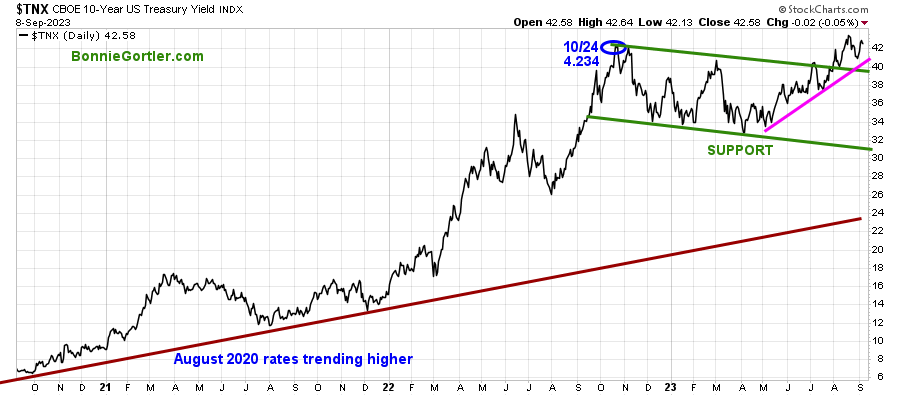

Figure 5: UST 10YR Bond Yields Daily

Source: Stockcharts.com

The 10-year U.S. Treasury yields rose last week, closing at 4.258%, remaining above the channel and the May uptrend (pink line). Support is 4.00 and 3.80%. A close breaking the May uptrend, below 3.80%, is likely to be positive for equities.

On the other hand, a close above 4.50% would likely lead to further short-term selling pressure in equities.

Last week, the major market averages were all lower. The Dow fell -0.75%, the S&P 500 was down -1.25%, Nasdaq down -1.93%, after back-to-back weeks of solid gains, while the Russell 2000 Index fell sharply -3.61%, the weakest market average, which is not a favorable sign for the near term.

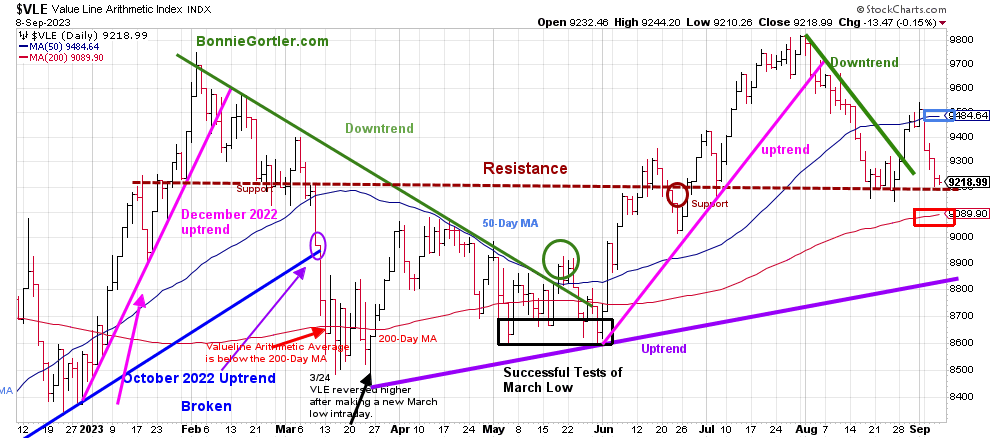

Figure 6: Value Line Arithmetic Average

Source: Stockcharts.com

The Value Line Arithmetic Index ($VLE) is a mix of approximately 1700 stocks. VLE broke the October 2022 uptrend in early March (blue line), reversed higher, and in April, May, and June had successful tests of the low.

The uptrend remains intact from March (purple line).

Last week, VLE fell -3.09%, flipping below the 50-day MA (blue rectangle), a sign of underlying weakness. However, it remains positive that VLE closed above the 200-day MA (red rectangle), which has not penetrated since June.

Resistance is 9500 and 9700. Support remains at 9200 and 8800.

Two closes below 8800 would break the March uptrend and be a warning of a potentially serious decline.

Do you want to go deeper into charting? Learn more in the comfort of your home today with my Free 33-minute Training, Charting Strategies to Cut Risk and Trade with the Trend. Sign up here

Weekly market breadth was negative on the New York Stock Exchange Index (NYSE) and for the Nasdaq. The NYSE had 750 advances and 2301 declines, with 119 new highs and 210 new lows. There were 1294 advances and 3458 declines on the Nasdaq, with 145 new highs and 467 new lows.

It’s unfavorable that market breadth weakened again, with more stocks making weekly New Lows and fewer stocks making weekly New Highs on the NYSE and Nasdaq. For a rally to be broad and sustainable, breadth needs to improve considerably.

If you want to go more in-depth with charts, I invite you to join my FB group Wealth Through Market Charts.

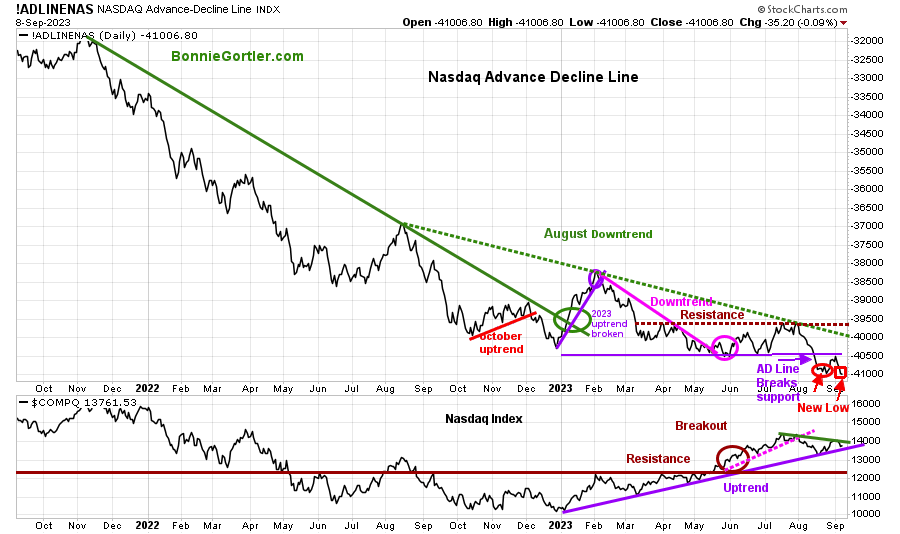

Nasdaq breadth remains worrisome

Figure 7: Nasdaq Advance Decline Line Daily (Top) and Nasdaq (Bottom)

Source: Stockcharts.com

The top chart is the Nasdaq Daily Advance-Decline Line, a technical indicator that plots the difference between the number of advancing and declining stocks. In January 2023, the October 2022 downtrend was broken (solid green line) but quickly reversed lower in February 2023, when most of the stock participation was the large Mega Cap Stocks.

The AD-Line (top chart) broke support (purple line) in August, remains weak after breaking below support (purple line), and is at a new low for 2023.

Nasdaq (lower chart) broke the short-term downward trend from July (pink dotted line) lower. However, it’s positive the 2023 uptrend remains intact.

It would be positive in the short term if the Nasdaq moves higher with more stocks advancing than declining. However, if the opposite is true, last week’s decline will likely continue.

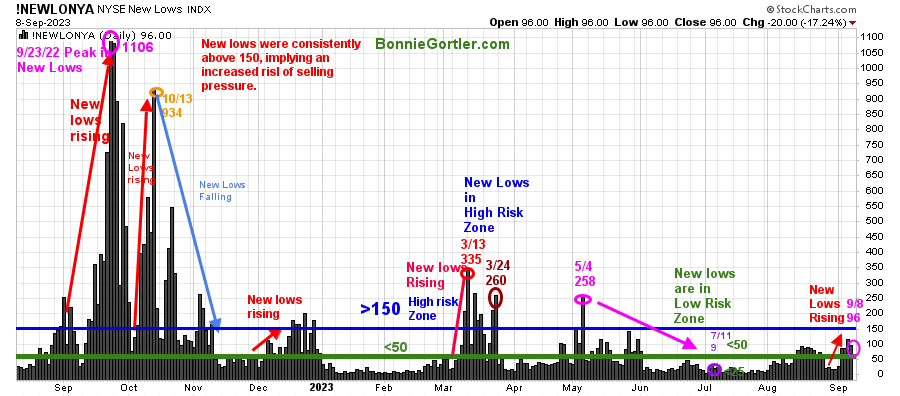

Figure 8: Daily New York Stock Exchange (NYSE) New Lows

Source: Stockcharts.com

Watching New Lows on the New York Stock Exchange is a simple technical tool that helps awareness of the immediate trend’s direction. New lows warned of a potential sharp pullback, high volatility, and “panic selling” for most of 2022, closing above 150. The peak reading was 9/23/22 when New Lows made a new high of 1106 (pink circle), and New Lows expanded to their highest level in 2023 on 3/13/23 (red circle) to 335.

New Lows have risen in September (red arrow on the right), closing at 96 (pink circle) but not yet in a high-risk zone, above 150.

It will be favorable if New Lows trend lower early in the week and fall below 50 and ultimately below 25 (the lowest risk zone). On the other hand, two closes above 150 New Lows would imply an increased risk of downside pressure in equities that could accelerate.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

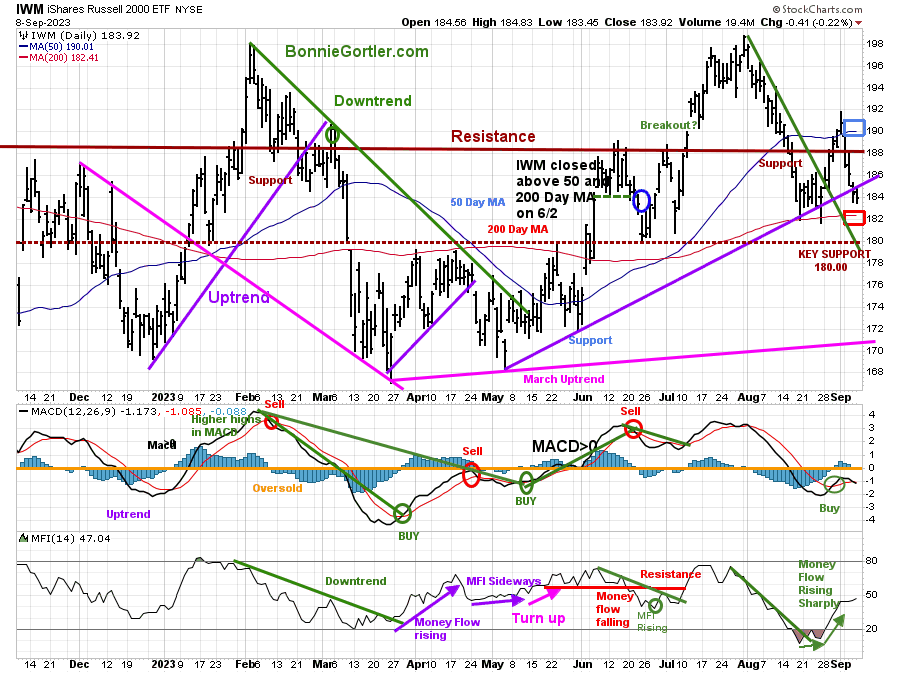

Figure 9: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle and Money Flow (Bottom)

Source: Stockcharts.com

The top chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue line) and 200-Day Moving Average (MA) (red line) that traders watch and use to define trends.

IWM fell -3.72%, closing at 183.92, flipping from above the 50-day MA (blue rectangle) to below.

Support is at 182.00, 180.00 and 172.00. Resistance is at 188.00 and 190.00.

MACD (middle chart) is on a buy, below 0, and falling.

Money Flow (lower chart) trended down in July and then rose sharply from an oversold condition in August. Despite the fall, money flow is increasing at a slower pace.

However, it’s unclear if buyers will step in or if more selling pressure will occur and IWM will break support.

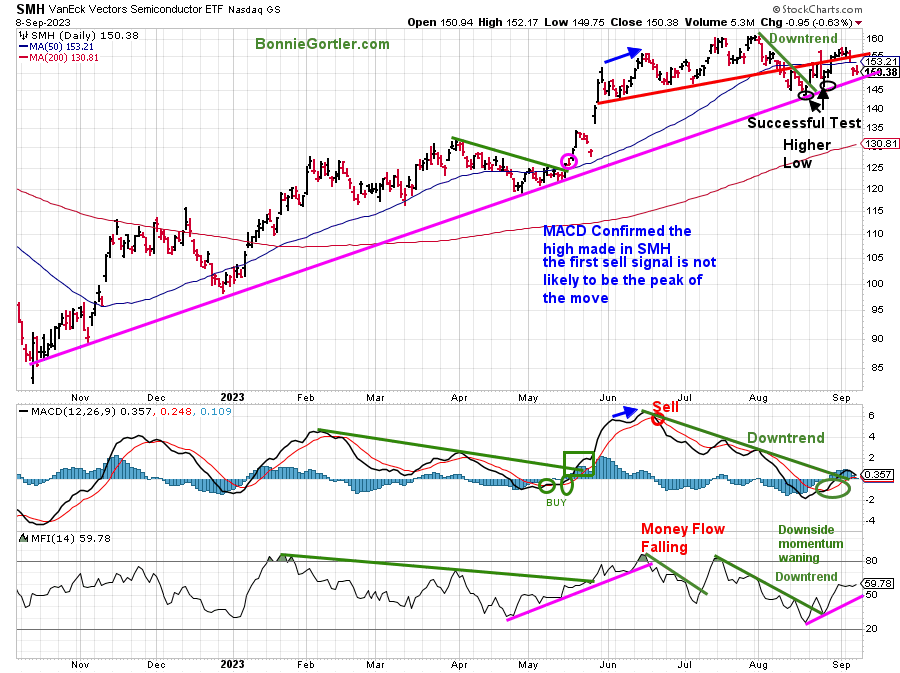

Figure 10: Daily Vaneck Vectors Semiconductors (SMH) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top chart shows the Daily Semiconductors (SMH) ETF, concentrated mainly in US-based Mega-Cap Semiconductors companies. SMH tends to be a lead indicator for the market when investors are willing to take on increased risk and the opposite when the market is falling.

Semiconductors (SMH) was under selling pressure last week, down -3.73%, weaker than the QQQ, not a good sign. Support is at 145.00, 140.00 and 130.00. Resistance is at 152.00,155.00, and 160.00.

SMH has so far successfully tested the August low while remaining in an uptrend from November 2022 (bottom pink line).

Its positive MACD (middle chart) broke the momentum downtrend (green line) from June, but so far, real thrust to the upside since the break of the downtrend.

Money Flow (lower chart) broke its uptrend from July (green line), rising sharply above 50, and is still in an uptrend from August, which is positive but now as encouraging as last week unless Money Flow turns up from here.

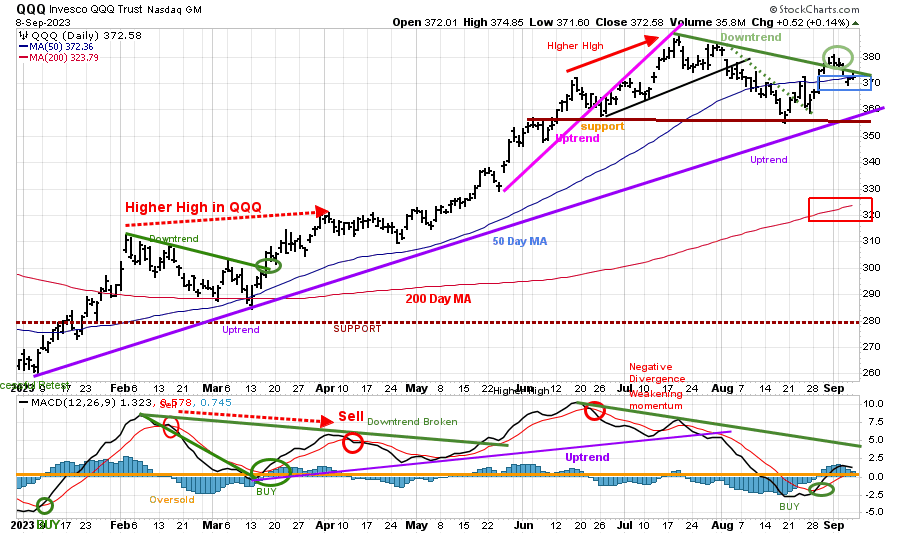

Figure 11: Daily Invesco QQQ Trust (QQQ) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The chart shows the daily Invesco QQQ, an exchange-traded fund based on the Nasdaq 100 Index. QQQ made a low in October 2022 (red circle), followed by a successful retest of the low in early January 2023 and the start of a strong uptrend.

QQQ remains in an uptrend for 2023 but has trended down since July’s peak.

Last week, it fell -1.33%, closing at 372.58. QQQ flipped below the 50-day Moving Average (blue rectangle) while remaining well above the 200-day Moving Average (red rectangle).

Support is at 370.00, 360.00, 355.00, and 335.00 with resistance at 380.00 and 390.00.

The bottom chart is MACD (12, 26, 9) is on a buy.

The downside momentum has subsided. However, there was no upside follow-through last week, which is concerning, but I remain hopeful of higher prices as long as the 2023 uptrend remains intact.

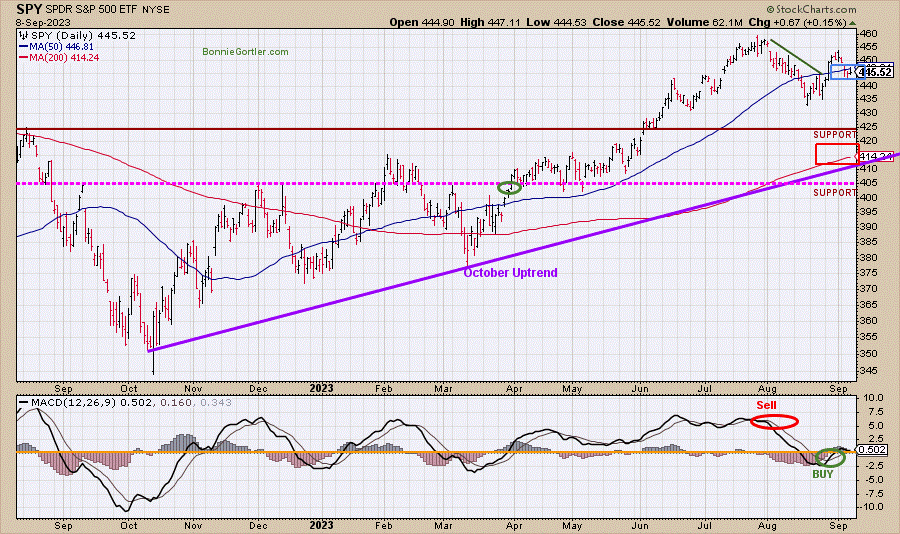

Figure 12: The S&P 500 Index (SPY) Daily (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The S&P 500 (SPY) remains in an uptrend since October 2022.

SPY fell 1.26%, closing at 446.52.19, slightly below the rising 50-day Moving Average (blue rectangle) but above the 200-day Moving Average (red rectangle).

MACD (bottom chart) is on a buy.

Resistance is 452.00 and 460.00. Support is at 445.00, 425.00, 410.00, and 405.00.

With the support and the uptrend (purple line) holding, I remain hopeful there will be another attempt higher, potentially breaking the August highs. My positive outlook would change if the SPY closes below 425.00.

Summing Up:

The major averages were lower last week and so far have held support, which is a plus after many August daily downtrends broke the previous week. It is concerning last week that there was no follow-through to the upside, However, the odds favor the bulls with short-term momentum oscillators no longer accelerating downward and are in a position from where tradeable rallies occur. Positive market breadth on the NYSE and Nasdaq and strength in Small-Cap, Technology, and Semiconductor stocks are needed for the major average to work its way higher. The retracement in August seems normal after a strong start in 2023. Higher prices are likely as long as support remains intact. Remember to manage your risk, and your wealth will grow.

Let’s talk investing. You are invited to set up your Free 30-minute Wealth and Well-Being Strategy session by clicking here or emailing me at Bonnie@BonnieGortler.com. I would love to schedule a call and connect with you.

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.